Economic Overview & Indices

GREECE

Despite the favorable international economic environment, underpinned by the weaker euro and lower oil prices, economic recovery in Greece remains fragile. Economic sentiment and specifically consumer confidence indicators deteriorated in April – August 2015, as the political turmoil with the forth coming elections, the recent prolonged negotiations with the official creditors and the Capital Control, heightened uncertainty. This vulnerable environment led to a re-escalation of Greek government bond yields.

CYPRUS

During the first semester of 2015 the Cyprus economy showed some signs of stability, with the economy’s performance being better than expected and tourism mildly outperforming forecasts.

Signs of improvement for the 1st semester of 2015 and economic developments have been encouraging. The recession in 2014 was milder than expected and GDP growth was positive in the first quarter of 2015 for the first time in almost four years.

SERBIA

According to the NBS, despite strong fiscal consolidation measures, GDP will stagnate in 2015, thanks to a smaller decline in private consumption and a faster recovery of net external demand. On the other hand, recovery of the energy sector is likely to lead to positive GDP rate in the second half of 2015.

REAL ESTATE SUB MARKETS

Office

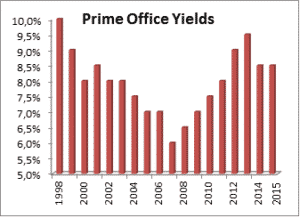

| ATHENS

The office sector in general has been stabilized. Rental prices in prime office locations have been stable in general and fluctuate between 8€ and 19€/sq m with few exceptions. |

|

|

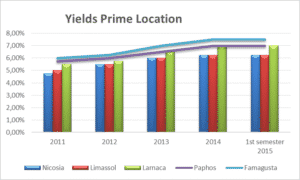

| CYPRUS

During the 1st semester of 2015 the office Market in Cyprus has shown a sign of stabilization in comparison with the previous semester. The office market unexpectedly is performing relatively well focusing in the cities if Nicosia and Limassol. Demand is mainly for Grade A office in prime location. Foreign investment has shown interest for income producing assets with rate of return between 4, 5 – 7%. |

|

SERBIA

Belgrade office market has shown positive trends in terms of new transactions, marking 23 transactions with average deal size of 938 sq m GLA at the end of Q1 2015.

Total take up for Q1 2015 reached 21.500 sq m GLA out of which 13.200 sq m GLA (62%) was related to net take-up and 8.300 sq m GLA (38%) to renewals and renegotiations of existing contracts.

Residential

ATHENS & THESSALONIKI

The residential market remains stable with few transactions. The prices seem to have been stabilized from 2015, at a quite low level, with the trend for further decline.

CYPRUS

Following some signs of stability in Cyprus economy the residential property values continue to fall, however, was the smallest change after 3 years of accelerate reductions.

Across Cyprus, movements in property prices appear mix as residential prices for flats fell by 0.4%. The biggest drop being in Limassol (1.0% for flats).

SERBIA

According to the official data for Q1 2015, average sale price for sold apartments in Serbia was EUR 848 / sq m, while for Belgrade area it was EUR 1,109 / sq m. Asking prices for mid-range apartments in Belgrade range from EUR 1,200 – 1,800 / sq m, VAT included, depending on the location.

Retail

ATHENS

The most severely hit of the real estate market, is the retail sector. During the first semester of 2015, there was some activity. Big retail brands seem to take advantage of the historical low prices in the major retail streets. Overall prices have been stabilized, vacancy has dropped, and absorption has increased.

CYPRUS

In the broader area of Nicosia, investment returns for shops and offices fluctuate between 6.5% and 8%. Market values for shops that are located outside Nicosia centre appear to be lower. Retail development is concentrated in the 4 main cities (Nicosia, Limassol, Larnaca, Paphos).

SERBIA

Retail stock in Serbia is estimated at 790,000 sq m. Modern shopping center stock in Belgrade is estimated at 230,000 sq m, whereas the prime shopping center stock is 128,000 sq m of GLA.

The strongest demand amongst both local and international retailers is for retail park projects that have been developed in the last several years, due to the lowest costs of leasing space in such projects. As for street retail, there is a slight demand.

Yield remains stable at 9% for prime shopping malls and 9.5 – 10% for retail warehouses.

AS A CONCLUSION

|

GREECE is at the border line of make or break. Given though its geopolitical importance, its size and opportunities offered for investments, we strongly believe that it will gradually leave recession and enter growth. |

|

CYPRUS is doing remarkably well having in mind the problems it was facing two years ago. The property market is becoming lively again and the future looks promising. |

|

SERBIA is a new player in Europe. Its privatizations are now on track, new private commercial and residential projects are being build and the market is expected to attract future investments once the country enters the European Union. |